The Rise of The Finfluencer: Gen-Z Are Binging Payday Routines

Since the dawn of the influencer, one style of content has consistently infatuated audiences: following their mundane, daily rituals.

This comes in many flavors, from relatable "Day In My Life" videos by YouTubers like Emma Chamberlain to fitness influencers showing the audience in detail everything they eat throughout the day.

Over time, those videos have become a dime a dozen. People are tired of seeing the day-to-day lives of these online personalities and are becoming more interested in how these lifestyles are sustainable.

In short, they want to know how much cash these influencers are raking in.

This curiosity into what personal finance actually looks like (as a generation with little to no personal finance education themselves) is seen not just as entertaining, but genuinely useful.

Watching these 'finfluencers', like @itserinconfortini on TikTok, allows them to raise questions like what a RothIRA is or how much to keep in an emergency fund, things they otherwise may not have independently considered:

Where Did Personal Finance Influencers (Finfluencers) Come From?

Though slightly dystopian, the concept of a steady, hefty paycheck has become just as coveted and niche as a collection of luxury handbags. Audiences now sit through budgeting videos with the same salivation they once did for hour-long PR package hauls.

Why? While it's likely a combination of several algorithmic factors, all signs point to Gen-Z's newfound obsession with personal finance education.

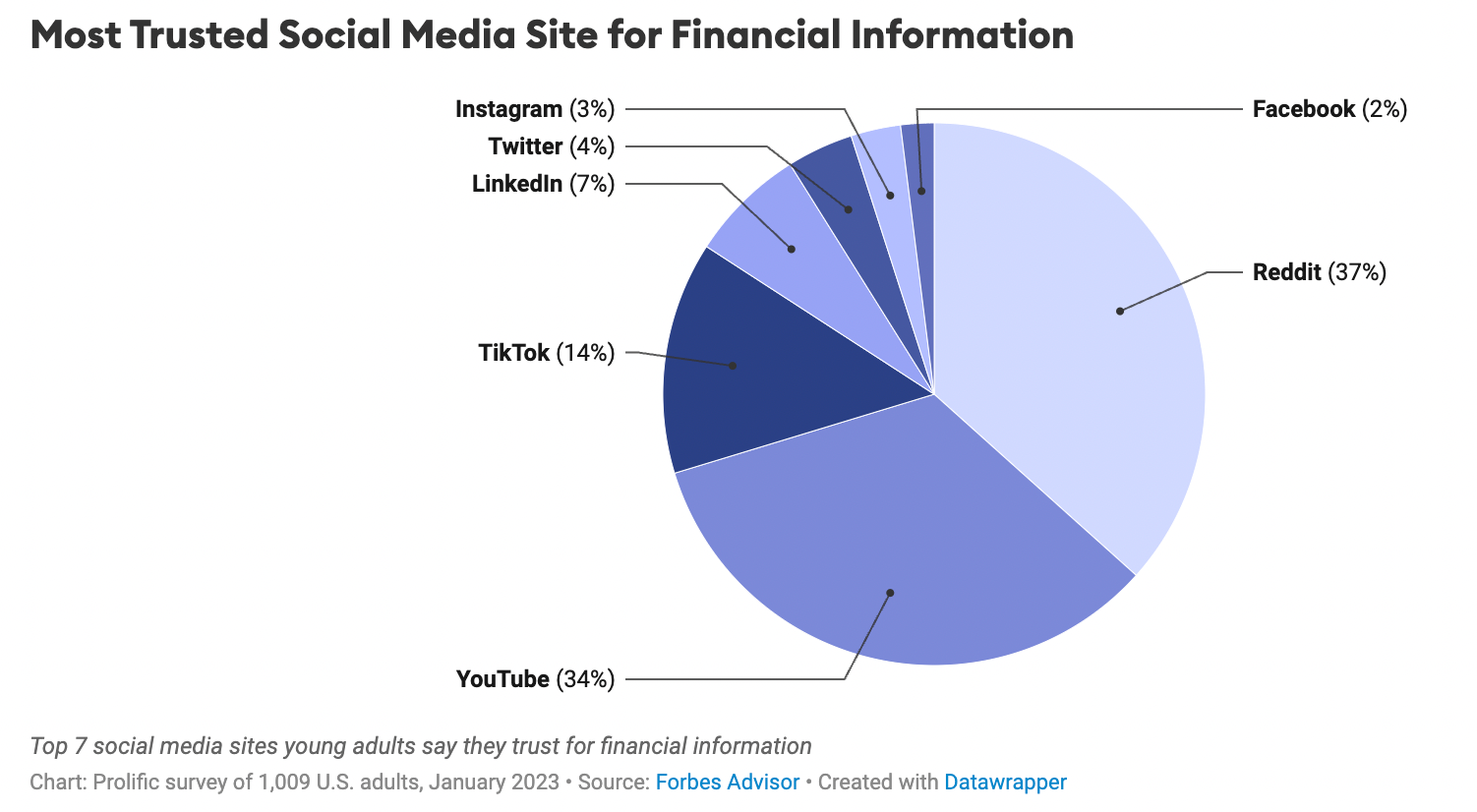

Since personal finance is not often covered in the American public school system, today's youth have opted to figure out economics the way they know best: via social media.

According to a Forbes Advisor study, "Nearly 7 in 10 of [Gen Z and Millenials] surveyed (69%) encounter financial advice on social media at least once a week, and 1 in 4 stumbles upon it every day."

The same study found that 66% of those surveyed believe they are more financially literate than prior generations.

With young people becoming more eager than ever, a gap has been created in the content creation space. Now, there are thousands of 'finfluencers' looking to fill in as the go-to resource for all things side hustles, passive income, and budgeting.

This is great, right? Well... yes and no.

Learning Finance Through Social Media: Beneficial or Detrimental?

There's nothing inherently wrong with Gen Z using the resources available to them to try to navigate the notoriously complex financial space.

The trouble, though, is that finance isn't the same as any other niche.

Finance is a topic that more and more online creators are breaking into, but not all of them have the education necessary to preach their 'expertise' to the impressionable masses.

The core issue? Buying the wrong product can ruin your week; Buying the wrong stock can destroy your savings.

While it's fair to say that the majority of the most popular financial creators have good interests at heart, that doesn't mean that scams aren't prevalent in these spaces:

FTX: A Massive Finfluencer Crypto Scam

Perhaps there's no better case study for why financial influencers should be taken with a grain of salt than the FTX cryptocurrency scam.

To put it in incredibly simple terms, a man named Samuel Bankman-Fried (once known as the world's richest 29-year-old) was peddling his own cryptocurrency, FTX.

From 2019 to 2022, he took billions from FTX customers, using it for his personal spending, political donations, and to cover debts for his other company, Alameda Research.

Despite promising customers their funds were safe, he secretly funneled their money to Alameda and lied about it. His fraud caused many people to lose their life savings, leading to his conviction on multiple charges.

But, this scam couldn't have succeeded without something very important: The help of several famous YouTube finfluencers.

These YouTubers, with upwards of 3 million subscribers, advertised the coin in their videos. This led their fans, who trusted them immensely, to 'invest' their hard-earned money into what was effectively the most annoying embezzling scheme of the 21st century.

What to Look Out For: Finfluencer Red Flags

As we discussed, these sorts of scams are unavoidable. However, that doesn't mean that every financial influencer is out to get you and your wallet.

There are precautions to take and observations that can be made to ensure that you don't fall victim to a similar scam while trying to further your financial knowledge. Here are some of the most common red flags in fraudulent finfluencers:

- Undisclosed Sponsorships: This one ain't just bad—it's illegal. The FTC requires finance creators to disclose any sponsorships or affiliate brand relationships.

- Pushy Sales: It's not uncommon for influencers of any variety to have a product, course, or service that they use their content to promote. However, if they use language that makes definitive promises (for instance, $10K in a month guaranteed), be wary of their intentions and take their advice with caution.

- All Talk, No Receipts: If a finfluencer is constantly bringing up their incredible profit margins, luxury lifestyle (Tai Lopez's infamous Lamborghini video is a great example here), and financial cure-all, they better have thousands of testimonials to back it up.

- Bombardment of Advertisements: Content creation isn't always lucrative without a few sponsorships. In fact, it's not uncommon to have a brand partner in every video these days. That being said, if your favorite YouTuber has three ad breaks per video and a paywall behind every piece of advice, you might be dealing with someone more money-motivated than someone with a genuine desire to help.

Personal Finance Content is Here to Stay

While causation may be up for debate, one thing is certain: This content is having its heyday, and it doesn't seem like it'll be declining any time soon.

That's why it's more important than ever to stay sharp when it comes to consuming financial advice online, and why seeking diverse sources is always better than taking one's advice as the whole truth.

Also, damn it, let's be honest. Those budgeting videos are quite interesting to watch!

Want More Financial Content?

Speaking of diverse sources: If you're looking to find some camaraderie in your financial journey, it would be fantastic if you'd subscribe to my newsletter.

It's free, which already makes it an obvious choice for your budget! It comes with a weekly summary of financial resources, advice, and the priceless opportunity to learn from my many mistakes.

0 Comments Add a Comment?